family law

financial statements

What do I need to file for family law property proceedings?

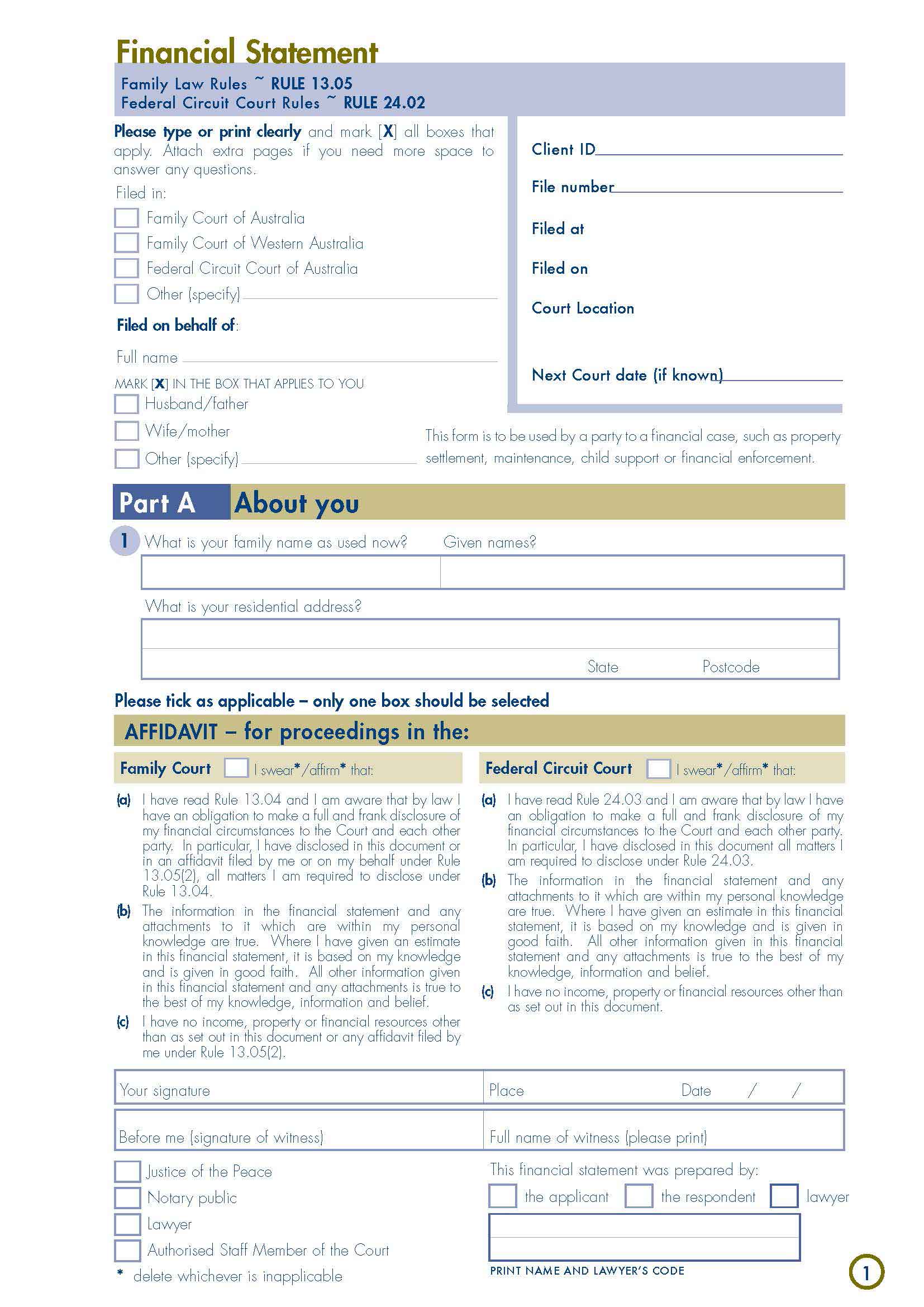

When you commence property settlement proceedings in the Family Court of Australia or Federal Circuit Court of Australia, it is necessary to file a Financial Statement. Similarly, when you respond to a financial case filed by a former spouse, it is also necessary to complete and file this document. A financial statement provides a summary of the financial details of the party including information about income, expenditure, property owned, superannuation and liabilities.

A Financial Statement is a sworn document, taking the form of an affidavit. The requirement to make full and frank disclosure under Rule 13.04 of the Family Court Rules or Rule 24.03 of the Federal Circuit Court Rules means that it is essential that it is completed accurately. Non-disclosure of relevant financial details may impact on your credibility as a witness in proceedings and/or result in a costs order against you. Where there are significant changes in financial circumstances, you must file a financial statement so as to update the other party and court of these details.

Details Recorded in Financial Statements

Income

You are required to provide details regarding weekly income derived from salary/wages, interest earned, government benefits, monies received from trusts, periodic superannuation payments, workers compensation, income protection insurance, termination/redundancy payments. All figures specified are weekly gross figures

Personal Expenditure

Under this section, you are required to specify weekly expenses incurred including income tax payments, personal contributions towards superannuation, mortgage/rental payments, council rates/taxes and local government charges, mortgage payments and expenses arising from investment properties.

Property Owned by You

You are required to disclose details of all property you own including real property, all accounts held in banks/building societies/financial institutions, shares, life insurance policies, motor vehicles, interests in any business, household contents and personal property.

Liabilities

Information regarding income tax assessed and outstanding, credit card details, hire/purchase/lease agreements, personal liabilities (including HECS debts), personal business liabilities (eg trade debts owing as a sole trader or in a partnership) are to be disclosed in this section.

Superannuation

Details of all superannuation plans, including the name of the plan, the type of plan and gross value need to be provided.

Financial Resources

Where you expect to receive money from a claim such as a personal injury claim, it is important to fully disclose such details.

Disposal of Assets

There are differing rules as to the extent of disclosure required regarding disposals of assets, depending on the Court in which the matter is heard. Where the matter is in the Family Court of Australia, the Family Law Rules require disposals of assets in the 12 months before separation to be disclosed. If a matter is in the Federal Circuit Court of Australia, the Rules require disposals since separation to be declared.

A financial statement is a very important sworn document of the court. It is critical that the form is completed accurately to ensure that your case is not compromised. Our team of family lawyers are able to assist you with the preparation of this document so as to avoid unnecessary complications in the progression of your case. Contact us today on 1300 148 110 and let us help you.

read more about financial disclosure in family law